The Usual Suspects

6 Oct 2023: China remains key to crude tanker demand in 2024

The IEA estimates that China has now overtaken the US as the country with the largest refining capacity with 18.2 million barrels per day (Mb/d) in 2022, representing about 17.7% of the global capacity. The IEA projects that China’s refining capacity will grow by a further 1.5 Mb/d by 2028 to 19.7Mb/d. As China only produces about 4.3 Mb/d crude oil, they are by far the largest importer of crude oil and therefore a significant driver of the tanker market. This week we will examine the dynamics of Chinese crude oil imports.

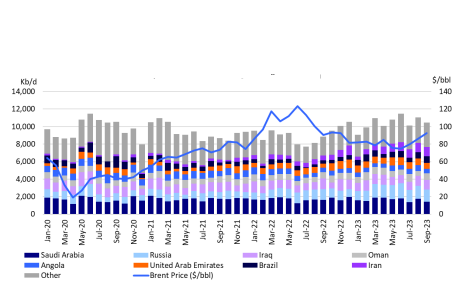

So far in 2023, Vortexa data shows that seaborne crude oil and condensates imports of China have averaged about 10.4 Mb/d. This is about 1.4 Mb/d more than in 2022 and 0.7 Mb/d more than in 2020. Additionally, China has agreements to import about 800 Kb/d of pipeline crude from Russia through the ESPO pipeline system and for about 200 Kb/d piped from Kazakhstan into northwestern China. So far in 2023 Saudi Arabia is still the largest exporter of seaborne oil to China with 1.66 Mb/d, followed by Russia at 1.44 Mb/d (although Russia exceeds Saudi Arabia in total imports due to pipeline volumes) and Iraq at 1.04 Mb/d.

Please fill out the form to read the article.