Sea Change In Product Trades

European import ban has boosted global product flows

In retaliation for the invasion of Ukraine, the EU banned the imports of all Russian refined products starting 5 February 2023. At the same time, a global price cap was put in place by the G7 countries. This price cap bars Russian access to western shipping companies, insurers and other maritime service providers, unless the refined products are sold for $100/barrel or less.

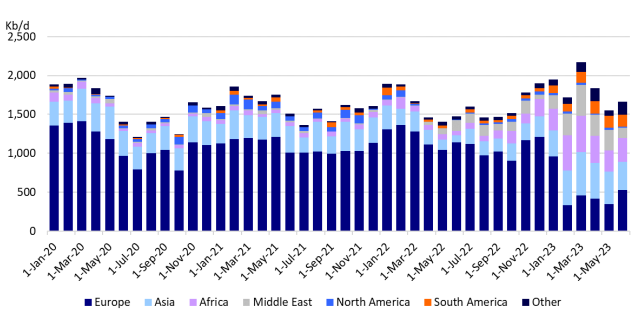

The EU import ban, in combination with the price cap was intended to keep oil products flowing, but at the same time capping Russia’s revenues. So far, it seems that those objectives are being met. According to Vortexa, Russia’s seaborne product exports averaged 1.69 Mb/d from January 2020 until February 2022 (the month of the invasion). Exports dipped slightly to 1.66 Mb/d in the 11 months between the start of the conflict and the EU product import ban. Since the EU ban and the G7 price cap were implemented, Russian product exports have actually increased. In the period Feb-Jun 2023, seaborne product exports from Russia averaged 1.84 Mb/d.After a period of self-sanctioning, the implementation of the import ban and price cap has clarified the situation for charterers and shipowners and, combined with discounted pricing for the Russian products, this may have contributed to an increase in seaborne export volumes.

However, since the EU and several other OECD countries no longer import Russian oil products, the Kremlin had to find alternative customers. Who are these customers and what are the ripple effects on the global product trades. What happened to worldwide ton-mile demand and did certain product carrier segments benefit more than others?

Please fill out the below form to continue reading the article.