India Goes Shopping

March 12, 2021

How will India’s diversification drive impact crude tankers?

In terms of oil demand and impact on the tanker market, India has long been overshadowed by China. There are two key contributing factors that explain the difference. First, China’s economy and oil demand has grown much more quickly in recent decades, partly because they had a much larger population and faster GDP growth. However, that may be about to change. India’s population is growing much faster than China’s. Various international organizations such as the World Bank and the United Nations estimate that India’s current population growth rate is in the range of 1.2-1.3%, while China’s population growth has slowed to about 0.5% per annum. At this rate, India’s population could overtake China’s as early as 2022. By 2030, India’s population may be 50-100 million larger than China’s.

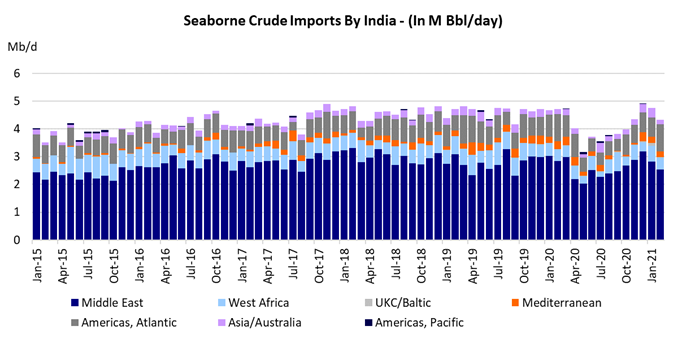

The second reason that tanker owners traditionally follow China’s oil demand much more closely than India’s is the proximity of the latter to the Middle East. India has traditionally bought the vast majority of its crude from their next-door neighbors in the Middle East. A barrel of crude going from the Arabian Gulf to India generates much less ton-mile demand than the same barrel going to China. That is why the recent reports that India intends to reduce its dependence on Middle East OPEC and buy more crude oil from suppliers in the Atlantic Basin is music to the ears of the tanker owners.

To read the full opinion, please fill out the form.