Back to the Negotiating Table

April 9, 2021

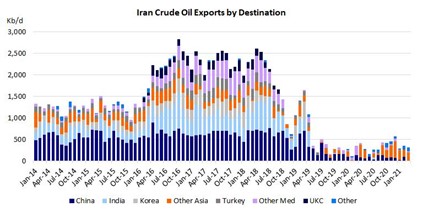

Would more Iranian crude exports help the tanker market?

OPEC+ has announced that it will gradually increase production from May through July of this year, potentially adding more than 2 million barrels per day (Mb/d) of crude to the market over this period. In theory, this should be good for the tanker market, because this oil will have to be moved somewhere. Despite concerns about continued high Covid-19 cases (and lockdowns) in Europe and a spike in cases in India and other parts of the developing world, OPEC+ seems to be confident that oil demand will continue to recover.

The news about the OPEC+ production increase was followed a week later by the announcement that the United States and Iran started indirect conversations (the parties are communicating through European intermediaries) in Vienna about reviving the 2015 Joint Comprehensive Plan Of Action (JCPOA), otherwise known as the Iran Nuclear Deal. A deal is by no means certain or imminent and negotiations will probably take a long time. However, even if the negotiations are successful, the impact on the tanker market is not clear-cut.

To read the full article, please filll out the form.