Money For Nothing And Ships For Free?

Explaining the variability in tanker owners’ TCE’s

Shipowners use a concept called Time Charter Equivalent earnings (TCE’s) to compare earnings across alternative trade routes and to measure spot rates relative to the earnings of a time charter. TCE’s, which are measured in US dollars per day ($/day), are defined as the daily earnings that are left after the owner pays for fuel and port expenses (voyage related costs). These TCE earnings are meant to pay for the fixed daily costs of operating a vessel, i.e. crewing, technical management, insurance, general & administrative (G&A) as well as contribute to the capital cost, debt service and interest.

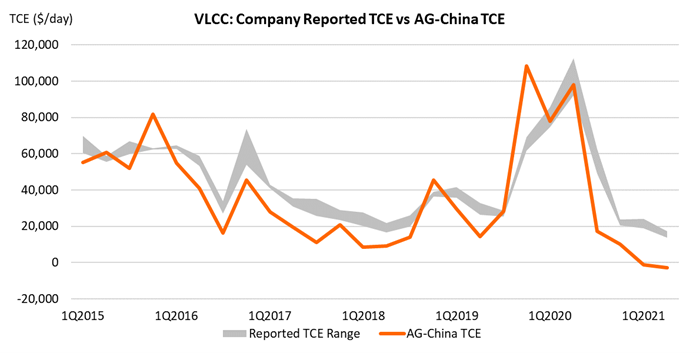

The TCE’s that vessels generate on the spot market are generally much more volatile than the daily hire that is paid under a fixed term contract, which is called the daily Time Charter Hire. The tanker market, as expressed in TCE’s has been very depressed over the last 12 months. VLCCs. the largest crude oil tankers, have been particularly hard hit. TD3c is the benchmark VLCC route that depicts the earnings of a large crude oil tanker moving 2 million barrels of crude oil from the Middle East to China.

The Baltic Exchange (an independent source of maritime market information) as well as all the major shipbrokers (including Poten) report the TCE’s on the TD3c-route daily. Once a quarter, these industry averages get a “reality check” when various publicly traded shipowners release their quarterly earnings, including the TCE’s for their various vessel segments.

In this week’s Opinion, we will try to find out why there is sometimes a wide discrepancy between actual earnings and broker reported TCE’s.

To read the opinion, please fill out the form.