Putin’s Rate Hike

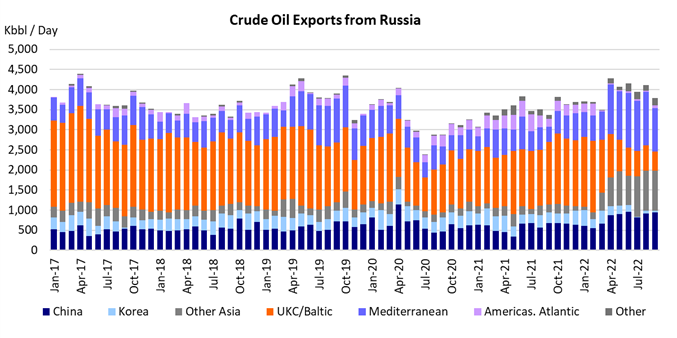

There is a high level of uncertainty around Russian exports

According to the latest World Economic Outlook, published on October 11: “Global economic activity is experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades.” This has led to widespread worries about a global recession. The Chinese economy, which has been the main engine of global oil demand growth in recent decades has slowed recently and the future looks uncertain, partly due to the country’s zero-Covid policy. OPEC+ has announced the biggest production cut since they throttled oil production by 10 Mb/d in May 2020 as a result of the global spread of Covid-19. At face value, these developments would not bode well for the tanker market. However, despite this, tanker rates have been on a roll in recent months. Why the disconnect?

The answer is obviously the Russian invasion of Ukraine. This conflict has created massive geopolitical tension, triggered a wave of sanctions against Russia and it has caused a lot of dislocations, inefficiencies and uncertainty in the tanker market. Owners and charterers alike face a difficult choice: is this market set for further inefficiencies and rates increases as the EU ban on seaborne oil imports goes into effect (December 5th, 2022 for crude and February 5th, 2023 for products), or will the economic headwinds and possible cutbacks in Russian exports lead to a substantial decline in tanker demand? The latter could lead to a substantially weaker tanker market going forward.

To read the full analysis, please fill out the form.