Oil Markets Are Rebalancing

22 May 2020

Production cuts are having an impact

What a difference a few weeks make. Freight rates in April went from strength to strength for both crude oil and product tankers as shipowners had the upper hand in a market where charterers were scrambling to get their hands on tanker capacity. The fear of running out of land-based storage capacity, in combination with a strong contango in the oil market spiked demand for floating storage. Observers knew this was going to be temporary, but most of us did not expect the correction to come this quickly.

OPEC+ implemented large production cuts starting in May, while, outside of OPEC, the U.S. shale producers also reduced output. As a result of these cutbacks as well as some early indications of demand recovery in China, oil spot prices recovered from their depths of April. This flattened the oil price curve, making floating storage uneconomical based on current freight rates. For the first time since March, the number of tankers engaged in floating storage declined last week. However, this week floating storage increased again.

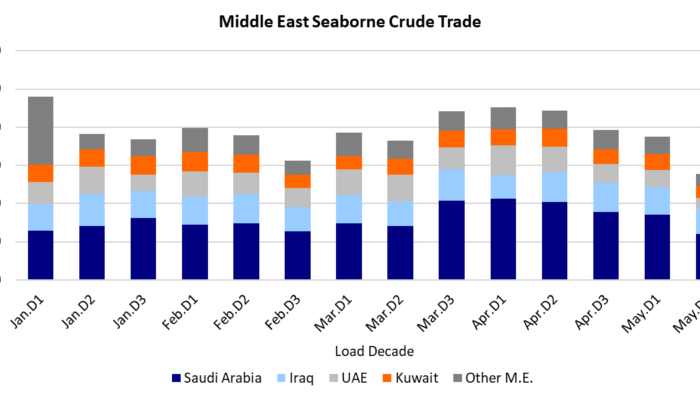

We will take a look at crude oil export activity in the first two decades of May to see where the biggest changes in shipments have been taking place.

To read the full article, please fill out the form.