LPG in World Markets: Freight Tumbles on Narrowing Arbs

This current feature was extracted from the latest edition of Poten’s LPG in World Markets, a monthly service published on January 10, 2024.

Many ships including very large gas carriers (VLGCs) are avoiding the Suez Canal following reports that several ships are being attacked by Iranian-backed Houthi small boats while transiting the canal, adding further uncertainty to the shipping sector since mid-December.

Around late-December, a container ship issued distress calls twice after being hit by a projectile in one day and then attacked by four small boats attempting to board the vessel the following day.

A multinational naval coalition is providing safeguards but there are daily reports of attempted attacks and hijacking. As a result, many VLGCs are opting to ballast back to the US Gulf Coast from the Far East around the Cape of Good Hope (COGH) instead of going through the Suez Canal. Going around the COGH instead of the Suez Canal can add four to seven additional days to reach the USGC. This has tightened the freight market, which has already been constrained due to the Panama Canal restrictions.

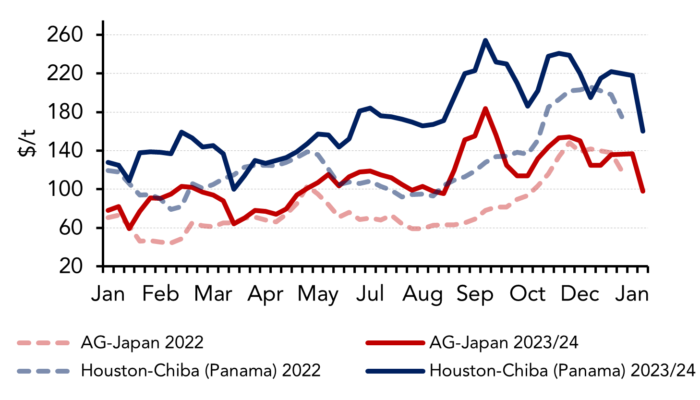

VLGC freight rates were trending down since mid-November but reversed course with the Houston to Chiba via Panama rate trading around $220/t in early January compared to $195/t before the Suez Canal disruption started. Ras Tanura to Chiba rates increased by around $10/t during that period to $135/t.

To read the full analysis, please click here.