- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LPG in World Markets Featured Article

Can US LPG Production Keep Up with Terminal Expansions

This current feature was extracted from the latest edition of Poten’s LPG in World Markets, a monthly service published on March 2025.

Now that we are assured that US NGL export capacity expansions will be quite substantial by 2028 and maybe even more than what the market needs in the near term, the question is whether US production will grow fast enough to fill up the terminals when these capacities become available.

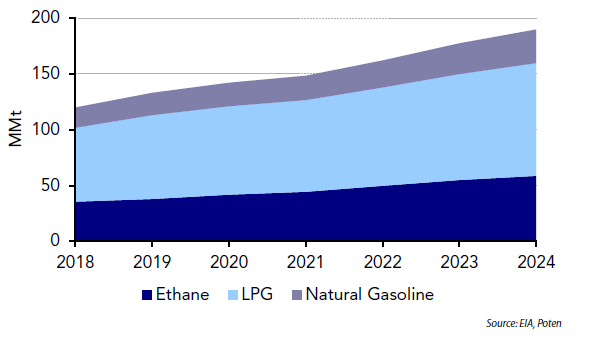

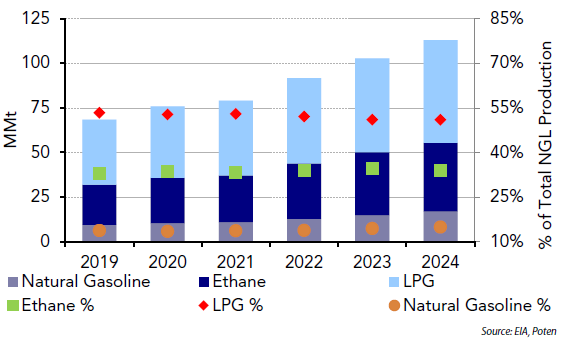

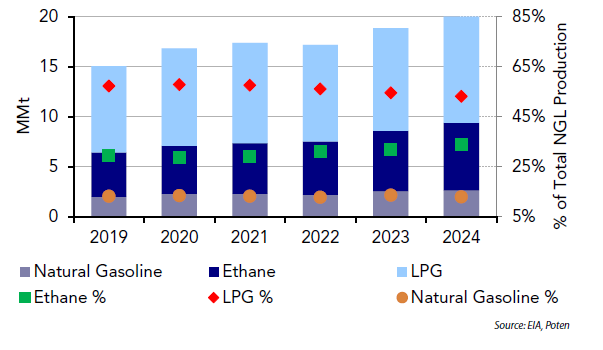

NGLs production (by weight) in 2024 was quite robust, with LPG production rising by 6.3% (6 MMt) to 101 MMt; ethane production was up 6.7% (3.7 MMt) to 58.7 MMt and natural gasoline was up 9.4% (2.6 MMt) to 30.1 MMt, according to the US Energy Information Administration (EIA) data. Growth slowed down for all purity products from 2023, when production growth for LPG, ethane and natural gasoline was 7.9% (6.9 MMt), 10.3% (5.1 MMt), and 14.1% (3.4 MMt), respectively.

US NGL Production Trend

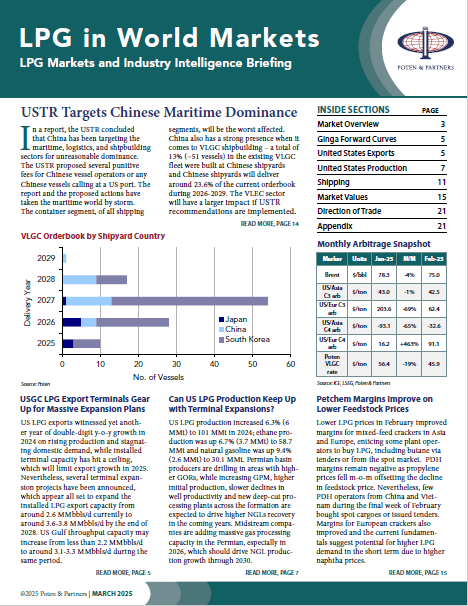

Analyzing the 2024 data further indicates that in the LPG mix, butane production increased the most at 6.5% to 22.5 MMt, followed by propane production, which is up 6.4% to 63.3 MMt and iso-butane, which is up 5.6% to 15.17 MMt.

US LPG Production Trend

Permian remains the main driver

More than 90% of the growth in NGL production came from the Permian basin in Texas and New Mexico. In fact, the Permian is the only region where shale gas production saw a meaningful increase in 2024, with a 13% y-o-y increase, according to the EIA. The only other regions where shale gas production increased in 2024 were in the Bakken and Niobrara; however, both regions account for a small fraction of total US gas and NGL production.

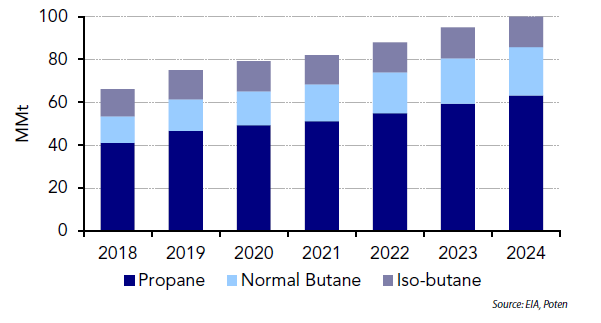

EIA data shows ethane production in Texas and New Mexico increased 9% (3.1 MMt) in 2024 to 38.5 MMt. In the previous year production of ethane was up 13% (4.1 MMt). LPG production increased in 2024 by 10% (5.2 MMt) to 57.7 MMt. In 2023, LPG production also increased about 10% (4.7 MMt). Natural gasoline production increased 13% (2 MMt) to 16.8 MMt.

The ratio of purity products in Permian has shifted slightly to recover more ethane in recent years. In the past two years, ethane accounted for 34% of overall NGL production by weight compared with 33% in 2021, while LPG accounted for 51% in the past two years, down from 53% in 2021. The ratio of natural gasoline has also increased slightly.

Looking ahead, the Permian will remain the largest driver for US NGL production growth and both producers and midstream companies are focusing their investments in the region. Moreover, producers are drilling in areas with higher GORs (gas to oil ratios), while increasing GPM (gallons per Mcf), higher initial production, slower declines in well productivity and new deep-cut processing plants across the formation are expected to support higher NGLs recovery.

New natural gas pipelines will also alleviate concerns about takeaway capacity bottlenecks, which will eventually support higher gas and NGLs production, even as crude oil production sees marginal growth. Keeping the focus on NGL production, several main midstream companies have announced planned expansions to support this production growth.

Texas and New Mexico Purity Products Production

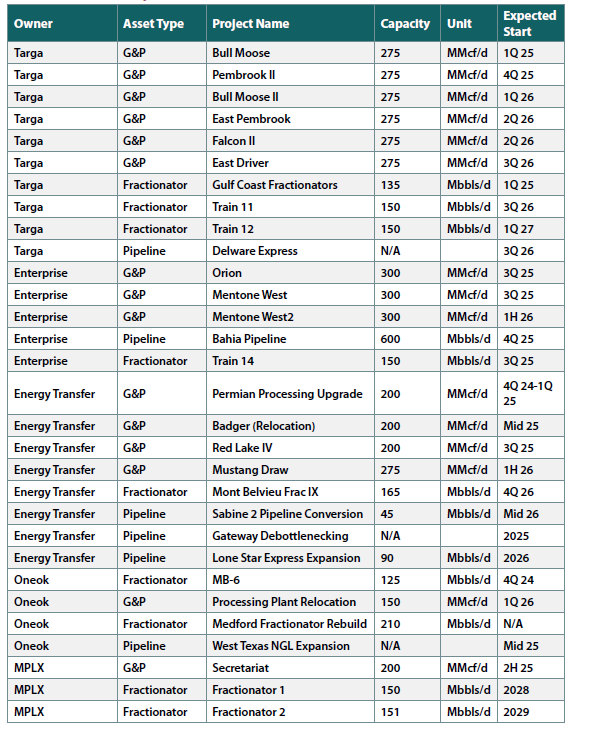

Targa, which has the largest footprint in the Permian for gathering and processing, said production of NGLs in the Permian was much higher than expected in 4Q, rising by 18% y-o-y, to 840,000 bbls/d. Fractionation volume was up 29% y-o-y to 1.09 MMbbls/d. The continued growth is driving massive investment interest. In 4Q 2024 and 1Q 2025, the company started two processing plants with 550 MMcf/d capacity in the Permian and has five additional projects underway each with 275 MMcf/d capacity with starting dates in 4Q 2025, 1Q 2026, and another two in 2Q 2026 and 3Q 2026. Targa will complete the frationator-11with 150,000 bbls/d in 3Q 2026 and announced plans to build fractionator-12, which is expected to come online about the same time as the export terminal expansion in 1Q 2027. The Delaware Express pipeline expansion project will expand the Grand Prix NGL pipeline by 100 miles and increase takeaway capacity from the Permian in 3Q 2026.

Enterprise Products is building three new gas processing plants in the Permian, two of which will start in3Q 2025 and the remaining plant will start in 1H 2026, increasing the company’s Permian gas processing capacity by 900-MMcf/d and NGL extraction capacity to 640,000bbls/d. Downstream, the company’s 600,000 bbls/d Bahia y-grade pipeline will start in 4Q 2025, increasing takeaway capacity from the basin to Mont Belvieu. Meanwhile, its fractionator-14 with 150,000 bbl/s will also start in 4Q 2025.

Energy Transfer (ET) is also building three new gas processing plants in the Permian, which will add675-MMcf/d. The plants will start in mid-2025, 3Q 2025 and 1H 2025. Additionally, upgrades to four existing plants will increase processing capacity by another 200-MMcf/d.ET is also investing in some pipeline conversion, debottlenecking and optimization work to increase existing NGL pipeline capacity to Mont Belvieu as well as purity products to Houston Ship Channel. Meanwhile, its 165,000-bbls/d fractionator 9 will also start in 4Q 2026.

In addition to the recent announcement of a new Gulf Coast export terminal with MPLX, Oneok has strengthened its position in the Permian following its acquisitions of EnLink Midstream and Medallion Midstream in 2024. To drive production growth Oneok is relocateing a 150 MMcf/d processing plant from North Texas to the Permian basin by 1Q 2026. In December, the company started the 125,000 bbls/dMB-6 fractionator in Mont Belvieu. Completion of the full looping of the West Texas NGL Pipeline system in the same quarter expanded the capacity to 515,000 bbls/d. Additional pump stations will further increase system capacity to 740,000 bbls/d in mid-2025. Meanwhile, outside of the Permian, the rebuild of the 210-Mbbls/d Medford, Oklahoma, fractionator which was damaged from an explosion in July 2022 – will allow more purity product flows from the Midcontinent to Mont Belvieu, supporting higher utilization of the Sterling purity products pipeline system. Elsewhere, MPLX is building a200-MMcf/d processing plant in the Permian that will start in 2H2025. The company is building a150,000-bbls/d fractionator on the Gulf Coast that will start in 2028, in line with their export terminal with Oneok. The company has announced plans to build a second fractionator in 2029 with a similar capacity. The capacity of the BANGL pipeline will increase in 2025 from 125,000 bbls/dto 250,000 bbls/d.

These new gas processing plants will provide an additional 3.25-8 MMt/y of ethane and 1.5-3.8 MMt/y of LPG production capacity in the Permian.

Infrastructure Projects to Drive Permian Production

Appalachia reviving

In the Appalachian region, NGL production growth was mainly attributed to increased ethane recovery, which jumped 12.8% (770,000 t) in 2024 to 6.8 MMt. LPG production increased just by 3.4% (352,000 t) to10.6 MMt. Natural gasoline production increased 1.3% (32,000 t) to 2.6MMt. However, natural gas production from the region declined 2% in 2024, according to the EIA.

The ratio of purity products in Appalachian has shifted substantially, with more ethane recovery in recent years. In 2024 ethane accounted for 34% of overall NGL production by weight, compared to comprising only 29% in 2021, while LPG accounted for 53% last year, down from 58% in2021. The ratio of natural gasoline has been steady at around 13%.

There are some optimistic outlooks for natural gas demand, which should reverse production decline from the Appalachian region and drive NGL production.

Antero Resources, one of the top five natural gas and NGL producers in the US, is projecting 29 Bcf/d of potential natural gas demand growth between 2024 and 2030 driven by LNG exports, exports to Mexico, demand from power generation driven by AI data centers, crypto mining, electric vehicles as well as higher industrial and rescomm gas demand.

Appalachian Region Purity Product Production

The company is projecting 2.1 Bcf/d of gas supply increase from the Appalachia, which if realized, will increase gas production by 6.4% in the next two years. Generally, NGL production increases at a higher rate than growth rate of natural gas. For example, Appalachian dry gas production increased 3% in 2023, which resulted in a 12% increase in ethane and 7% increase in LPG production.

MPLX will add the 300 MMcf/d Harmon Creek III processing plant and 40,000 bbls/d de-ethanizer to its Harmon Creek facility in southwestern Pennsylvania in late 2026.

Higher ethane recovery will be a key driver for NGL production growth. Midstream companies are also investing in infrastructures accordingly with dedicated new ethane export terminal capacity as well as flexible capacity that can switch between ethane, ethylene and LPG.

On the other end of the equation, ethane demand is also expected to increase at a higher rate in the next five years, driven by new ethane crackers in Asia and Europe, as well as a significant increase in the VLEC (very large ethane carrier) fleet. (see LPGWM, Sep ’24).

According to Antero, global ethane demand will increase by 800,000 bbls/d between 2025-2030, while propane demand will increase by 350,000 bbls/d during the same time.

PDH plants, LPG and ethane-based steam-crackers in China, India and Europe will be the main driver of demand growth. Although relatively high LPG prices, poor processing margins for chemical producers, slow GDP growth, geopolitical concerns and high terminal capacity utilization in the US will limit demand growth in 2025. With increasing supply from the US from 2026, NGL prices should adjust to drive higher demand.

Subscribe to Poten’s LPG in World Markets

Industry participants rely on Poten’s expertise in LPG shipping, advisory services and business intelligence for robust coverage of the global markets. To activate your subscription or learn more, connect with us today: [email protected]

Also available from Poten Business Intelligence: Short-term LPG Forecasting

Poten’s LPG Market Outlook

In-depth analysis of LPG markets, trade flows and industry developments

A short-term supply & demand forecast providing actionable, forward-looking data and analysis of LPG markets. Key coverage includes LPG supply, demand, trade forecasts and in-depth market insights.