- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LNG in World Markets Featured Article

Centrica Buys UK’s Grain LNG Terminal

This current feature was extracted from the latest edition of Poten’s LNG in World Markets, published on August 15, 2025

British international energy and services company Centrica and US energy infrastructure investor Energy Capital Partners (ECP) have acquired the 15-MMt/y Isle of Grain LNG terminal in the UK, one of the largest regasification facilities in Europe.

Announced on Aug. 14, the acquisition has an enterprise value of £1.5 billion ($2 billion) and is expected to be completed by the end of this year. Current owner National Grid, which is the UK’s electricity and gas company and the transmission system operator in England and Wales, will use the sale proceeds to partly fund decarbonization investment in the UK’s electricity sector.

Grain LNG is a critical regasification and rapid response gas storage facility. All its capacity is fully contracted until 2029 and over 70% of capacity is committed until 2038. Over 50% of capacity has been sold until 2045.

This supports an internal rate of return (IRR) of around 9% and an equity IRR of over 14%, said Centrica.

The acquisition is mainly funded by £1.1 billion ($1.5 billion) in non-recourse project financing, with Centrica and ECP supplying around £200 million ($271 million), each, inequity investment. The non-recourse debt is being raised by the acquisition company, National Grid and Garden Bidco Ltd. (Bidco), which is 50:50 owned by Centrica and ECP.

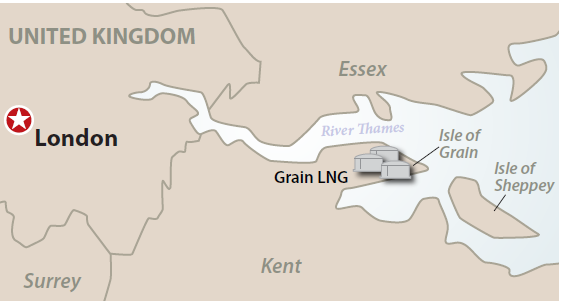

Bidco will acquire all issued share capital of National Grid Grain LNG Ltd. and Thamesport Interchange Ltd., which comprise National Grid’s business at the Isle of Grain on the Thamesestuary in Kent, southeast England.

Previous primary capacity holders at Grain have included Centrica, Shell, Sonatrach, TotalEnergies and Uniper. Other users have included E.ON and Iberdrola.

Grain’s 15-MMt/y regasification capacity is approximately equivalent to 20% of UK gas demand and is linked to the UK’s National Balancing point (NBP) gas market via its National Transmission System connections. Grain also has 1 Bcm of storage capacity. It is currently being expanded to add 5.3 Bcm/y (3.8 MMt/y) of regasification capacity and 200,000 m3 of storage capacity.

Centrica signs gas supply agreement with Devon Energy

A day after announcing the Grain LNG acquisition, Centrica said its trading arm, Centrica Energy, had signed a 10-year sales and purchase agreement (SPA) to receive 50,000 MMBtu/day of gas from US E&P company Devon Energy. This contract will start in 2028 and is equivalent to around 350,000 t/y or about five cargoes of LNG per year.

It will help Centrica manage its portfolio by aligning feed gas prices with European gas prices through indexation on the Netherlands’ TTF hub. It gives Devon Energy exposure to international gas prices which are typically at a premium to US Henry Hub.

The physical volumes from the Devon deal will be handled and optimized by Centrica Energy’s US subsidiary, which recently opened a New York office. In October 2024, Centrica signed an agreement to receive 100,000 MMBtu/d of gas (approximately 700,000 t/y) for 10 years, starting in 2028 from US E&P company, Coterra Energy. These volumes are linked to TTF and NBP (see LNGWM, Nov ’24).

Grain LNG

Centrica also holds contracts to lift 1.75 MMt/y from Cheniere’s Sabine Pass LNG in Louisiana and 1 MMt/y from the Delfin LNG FLNG1 project off the US Gulf Coast. Centrica will use some of these volumes to supply Brazilian oil and gas company Petrobras with 800,000 t/y of LNG for 15 years starting in 2027. The SPA with Petrobras was announced in February this year and is understood to be mostly linked to Henry Hub on a free-on-board basis (see LNGWM, Feb ’25).

Centrica operates the Rough storage facility off the northeast coast of England. Last month it welcomed a decision by the European Commission to relax underground storage targets (see LNGWM, Jul ’25).

ECP is one of the largest private owners of power generation and renewables in the US. It focuses on investing across energy transition infrastructure and in 2024 combined with London-listed Bridgepoint Group to create a middle market investment company with $87 billion of assets under management.

Subscribe to Poten’s LNG in World Markets

Industry participants rely on Poten’s LNG in World Markets business intelligence service for the best information to drive business success. To activate your subscription or learn more, connect with us today: [email protected]

Get to Know Poten’s LNG Business Intelligence Services

Actionable short term market intelligence

- Monthly country-level forecasts

- Global arbitrage analysis

- Detailed data on future trade flows

Analysis of LNG finance across the value chain

- Annual ranking of LNG lenders

- Detailed analysis of project lending

- Intelligence on project finance structure

- Insight on lending to the shipping sector

A 10-year price, supply and demand forecast

- 10-year projections

- Bottom-up demand forecasts

- LNG imports and exports

- Special focus on shipping

Insight on LNG markets, projects and the industry

- Commercial and technical details of global projects across the value chain

- Detailed coverage of spot markets with data and analysis on market fundamentals, price levels and trade flows

- Shipping activity and technology developments