- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LNG Market Outlook Featured Article

Winter Import Growth Reliant on Weather, Storage Levels

This current feature was extracted from the latest edition of Poten’s LNG Market Outlook, a monthly service published on October 25, 2024.

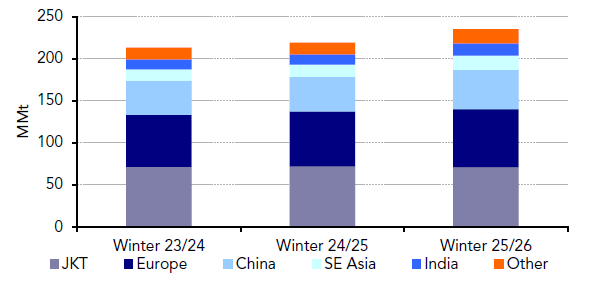

Storage levels, weather, geopolitics and prices are all primary market drivers influencing LNG demand, with winter demand in focus. Weather is currently mild in most of Europe and China at the time of writing, but colder weather patterns due to La Nina’s effect will drive LNG demand higher over the next five months. Winter LNG imports for Europe are forecast at 65.6 MMt in 2024/2025 – up from 61.7 MMt in the winter of 2023/2024 and 42.4 MMt from April through September 2024. A normal winter depletes storage levels and drives LNG demand higher. European LNG imports are expected to increase to 69 MMt in the winter of 2025/2026.

.

Winter LNG Import Forecast

Northeast Asian LNG imports are forecast to see minimal growth winter over winter this year due to alternative energy sources like nuclear power in Japan and Korea and coal and pipeline gas in China weighing on some LNG demand. However, gas demand growth in China will lift LNG exports next winter by 5.5 MMt to 46.7 MMt compared to the forecast for this winter.

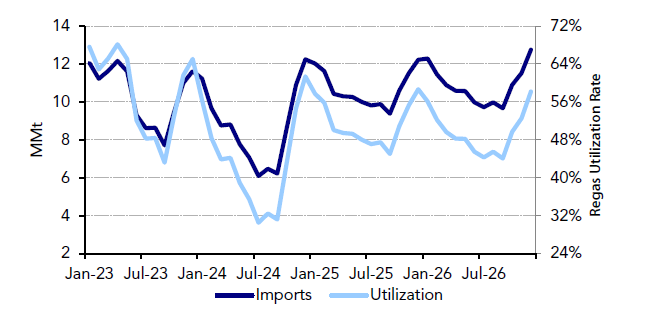

A rush to build out European regasification has left some terminals underutilized because of recent, weaker than expected LNG demand. Based on the current European LNG import and regasification forecast, underutilization is likely to persist through 2026. European regasification is forecast to expand from 214.2 MMt in 2023 to 263.1MMt by 2026. With the forecast calling for an increase in European LNG imports in 2025 and 2026, utilization should average 50% in 2025 and 2026.

Europe LNG Import Forecast and Regasification Utilization Rates

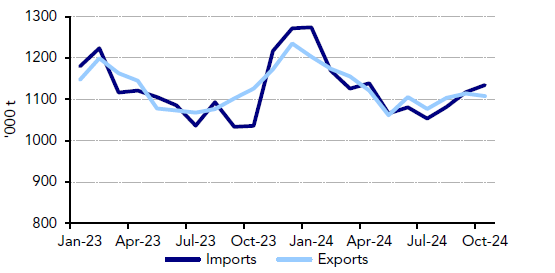

Imports are outpacing exports in the global LNG import and export balance through 1H October 2024. Europe and South Asia are the two major regions where LNG imports have picked up pace m-o-m. In South Asia, rising imports for India are being driven by relatively lower prices and struggling gas production. On the supply side, exports have risen m-o-m for the US, Australia, and Russia but Nigeria, and Qatari volumes are lower.

Monthly Average LNG Exports and Imports Comparison

Subscribe to Poten’s LNG Market Outlook

Industry participants rely on Poten’s LNG Market Outlook to identify and capture market opportunities in the increasingly complex LNG market. To activate your subscription or learn more, connect with us today: [email protected]

Get to Know Poten’s LNG Business Intelligence Services

Actionable short term market intelligence

- Monthly country-level forecasts

- Global arbitrage analysis

- Detailed data on future trade flows

Analysis of LNG finance across the value chain

- Annual ranking of LNG lenders

- Detailed analysis of project lending

- Intelligence on project finance structure

- Insight on lending to the shipping sector

A 10-year price, supply and demand forecast

- 10-year projections

- Bottom-up demand forecasts

- LNG imports and exports

- Special focus on shipping

Insight on LNG markets, projects and the industry

- Commercial and technical details of global projects across the value chain

- Detailed coverage of spot markets with data and analysis on market fundamentals, price levels and trade flows

- Shipping activity and technology developments