LNG Finance in World Markets: US Deals Dominate Liquefaction Funding

This current feature was extracted from the latest edition of Poten’s LNG Finance in World Markets, a monthly service published on June 29, 2023.

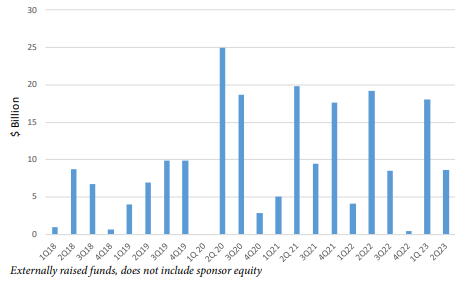

Liquefaction funding so far this year continues to be dominated by US deals. It reached almost $27 billion in 1H 2023 which is already higher than some recent full year tallies (see Charts). Of the 1H 2023 total, $24.7 billion was used to either fund or refinance US LNG export projects.

US funding levels looked set to jump even higher with NextDecade poised to reach a final investment decision (FID) on its 17.5-MMt/y Rio Grande LNG project and achieve financial close on $12 billion of debt (see p. 4). If Rio Grande LNG funding is included in the tally, that indicates that US project funding jumped over $37 billion – its highest-ever level.

We have included estimates for NextDecade’s debt and TotalEnergies’ 16.67% equity stake in the Rio Grande LNG project in the chart which shows US financing volumes by type of funding. Global Infrastructure Partners’ equity is not included because the percent holding has not been provided.

We have also included an estimate for ConocoPhillips’ 30% equity stake in Phase 1 of Sempra’s 13.5-MMt/y Port Arthur LNG project in the US Financing Volumes Chart, as well as its $265 million buy-in and KKR’s $180 million buy-in.

To read the full article, click here.