March Madness

March 13 2020

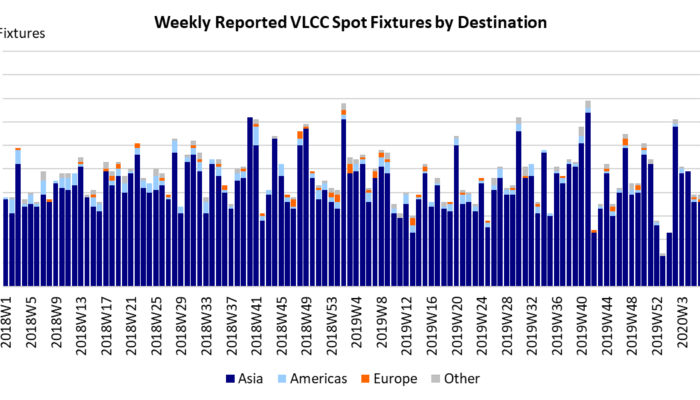

Tanker fixtures jump as producers prime the pump

We are near the end of another week of almost unprecedented volatility in the oil and tanker markets. It seems that the COVID-19 outbreak has put people and markets on edge and any change in outlook or unexpected event has an outsized impact on the markets. After the OPEC+ meeting concluded without an agreement one week ago, a quick succession of events in the oil market turned the crude oil tanker market upside down. Saudi Arabia significantly lowered its oil prices and announced their intention to increase production and exports. Global oil prices collapsed as a result.

The price for West Texas Intermediate (WTI) went from $45.90 per barrel on Wednesday, March 5, the day before the fateful OPEC+ meeting, to $31.13 per barrel on Monday, March 9. This was a drop of more than 30% and the oil market switched to contango. The events also ignited interest in floating storage and tanker markets started to percolate. A dramatic fixing binge by Saudi Arabia’s national shipping company, Bahri accelerated the rise in tanker rates.

Within a little more than a week, VLCC rates on the benchmark AG-Far East route went from $30,000/day to $210,000/day, a 600% increase. Why did rates go up so fast and where do we go from here?

Please fill out the form to read the article: